Different pumps and their GST rates applicable

Know About Smart Pumps Industry

May 16, 2019

Identifying the Right Personnel for a Pump Manufacturing Business

August 24, 2021Different pumps and their GST rates applicable

GST on various machineries

Goods and Services Tax (GST ) is a single tax on the goods and services from the manufacturer to the buyer. GST was introduced to bring equality in the prices of products across the country. The GST council has placed over 500 services and 1300 goods and under the tax slabs of 5%, 12%, 18% and 28%. Around 7% of total goods and services comes under the exempted list and 81% of total goods falls under the 18% slab. Following is information about different types of motors and the GST applicable on it.

GST Rate for different pumps

The GST rates for the pumps is mentioned under the HS code of 8413.This section describes the products ,namely,pumps for liquids, whether or not fitted with a measuring device.Following part of the article mentions different products and their GSTs To Know more, https://www.thehindubusinessline.com/opinion/pump-priming-measures-needed-for-economic-growth/article30357006.ece

Different pumps and their GST

- GST rate for handloom pumps and handloom parts

The GST rate for Handloom pumps and handloom parts is 5%. The GST for hand pumps and parts thereof is 5%.

- GST rate for Power driven pumps

The power driven pumps are largely used for water pumping activities. Power driven pumps like centrifugal pumps are useful for moving water to large distances and have better water flow regulation and control. Turbine pump is used in pumping water from deep underground

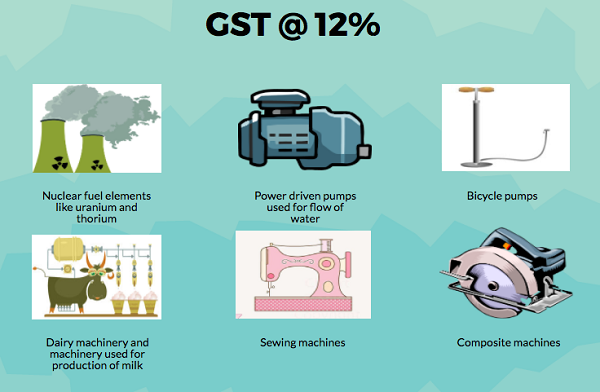

The GST rate for Power driven pumps designed for handling water like deep tube-well turbine pumps, Centrifugal pumps, axial flow and mixed flow vertical pumps, submersible pumps, were fixed at the rate of 12%.

- GST rate for concrete pumps

Concrete pump is used for transferring liquid concrete by pumping. The concrete pumps and other positive displacement rotary pumps have a GST fixed at 18%.

- GST rate for hydraulic pumps

The GST rate for hydraulic pumps for tractors is 12%.

- GST rate for Gasoline and dispensing pumps

A fuel dispenser is a machine used in filling stations and is used to pump gasoline, petrol, diesel , CNG, HCNG, CGH2 , LPG bio-fuels like kerosene or any other types of fuel into vehicles.

The GST rates of pumps for dispensing lubricants, fuel or the type used in filling stations or garages, fuel ,lubricating or cooling medium pumps for internal combustion piston engines is 28%.

- GST rate for bicycle pumps

The GST rate of bicycle pumps, other hand pumps and parts of air or vacuum pumps and compressors of bicycle pumps is 12%.

- GST rate for air or vacuum pumps

A vacuum pump is a device that removes gas molecules from a sealed volume. These are mainly used in industrial and scientific processes.

The GST rate for air or other gas compressors and fans, air or vacuum pumps, whether or not fitted with filters other than bicycle pumps, other hand pumps and part of air or vacuum pumps and compressors of bicycle pumps is 18%.

- GST rates for power driven pump parts

The GST rates for suitable parts that are solely or principally used with power driven pumps that are primarily designed for handling water, namely, deep tube-well turbine pumps, centrifugal pumps, axial flow and mixed flow vertical pumps and submersible pumps is 18%.

The validity of the above information about the GST rate must be verified before any business dealings.